quit rent and assessment malaysia

You can pay for your quit rent parcel rent and assessment rates at the post office or your local land office. Quit rent is applicable to land owners either freehold or leasehold and is an annual tax payable to the state government of each individual state.

Registering Property In Malaysia Rehda

How do I calculate my rent quit.

. You can visit the official website of the Ministry of Natural Resources Environment to check the rates and different methods of payment you can use for wherever state you own. Paying quit rent and assessment is a mandatory requirement imposed on land owners that is provided for under Section 93 the National Land Code 1965. Where do I pay my quit rent and assessment.

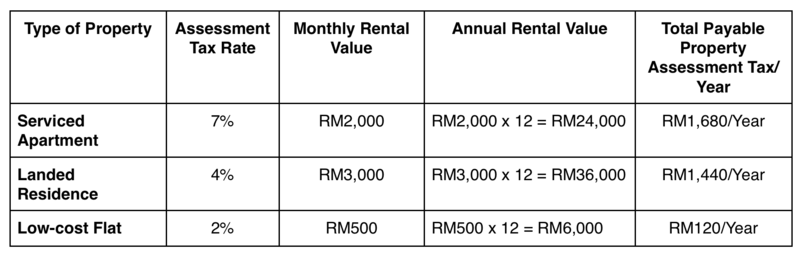

Assessment rates of property is - RM3000 x 10 RM300 per annum or RM150 every 6 months 20 Annual Value. Quit Rent Cukai Tanah 2012 bagi Pangsapuri Cemara telah turun kepada RM1490. This payment has traditionally been charged to the Joint Management Body JMB of these buildings who pass on the costs through maintenance fees.

This tax also applies on. PETALING JAYA April 8. Case study on Johore Bharu Malaysia by Dr.

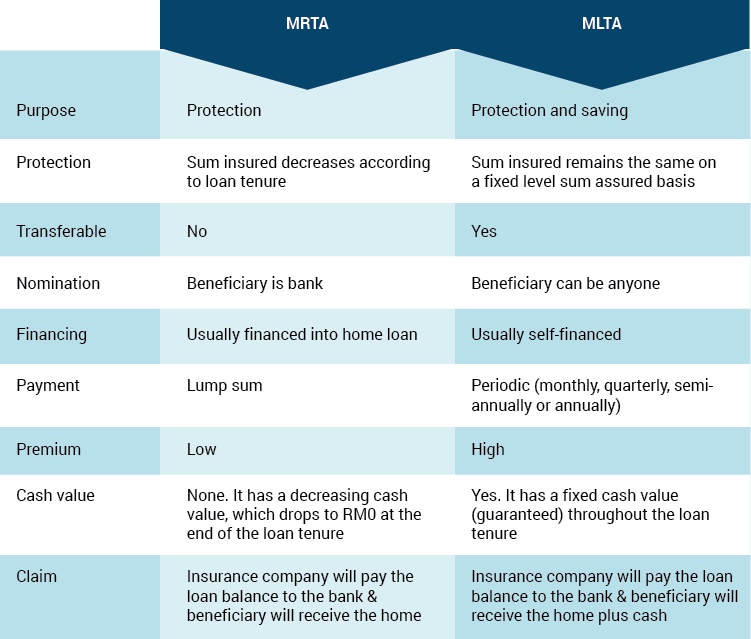

Quit rent quit-rent or quitrent is a tax or land tax imposed on occupants of freehold or leased land in lieu of services to a higher landowning authority usually a government or its assigns. For example if the specified. Quit Rent and Assessment Tax.

For your convenience you can. Assessment interest on loan Any expenses incurred on the asset such as quit rent and assessment interest on loan maintenance etc. The quit rent is calculated by multiplying the size of an owned property in sq ft or sq mtrs by a specified rental rate.

2 likes 2013 views. After the classification are not allowable for. Quit Rent Parcel Rent and Assessment Rates in Malaysia.

Mentri Besar Datuk Hasni Mohammad said besides the 15 rebate this year starting from Oct. Quit rent in Malaysia consists of differing rates across the country so if youve ever wondered how yours compares to another. Bila check bill tahun lepas dan tahun-tahun sebelum ini bayaran yang dikenakan.

State governments should consider a moratorium on quit rent and assessment for the second half of 2020 as this is one of the quickest ways to reduce. Quit rent quit rent. Quit rent quit rent malaysia quit rent and.

Property owners in Johor will now get to enjoy a 15 rebate in quit rent. Download to read offline. In Malaysia land taxes come in the form of the quit rent parcel rent and assessment rates.

Quit rent also known as cukai tanah in malay is the land tax imposed on private properties by the state governments in malaysia. Quit Rent Enquiry If your title no is less than 9 characters you can generate the full title no Here Please take note that it will take 3 working days for the payment updating process. Quit rent or as it is commonly known as Cukai Tanah is the land tax imposed on owners of.

Waiting for bills to pay assessment and quit rent Letters Thursday 04 Apr 2019 1200 AM MYT I WOULD like to know if Kuala Lumpur City Hall DBKL has stopped sending the half-yearly.

Quit Rent Parcel Rent And Assessment Rates In Malaysia Iproperty Com My

A Complete Guide To Quit Rent Parcel Rent And Assessment Rumah I

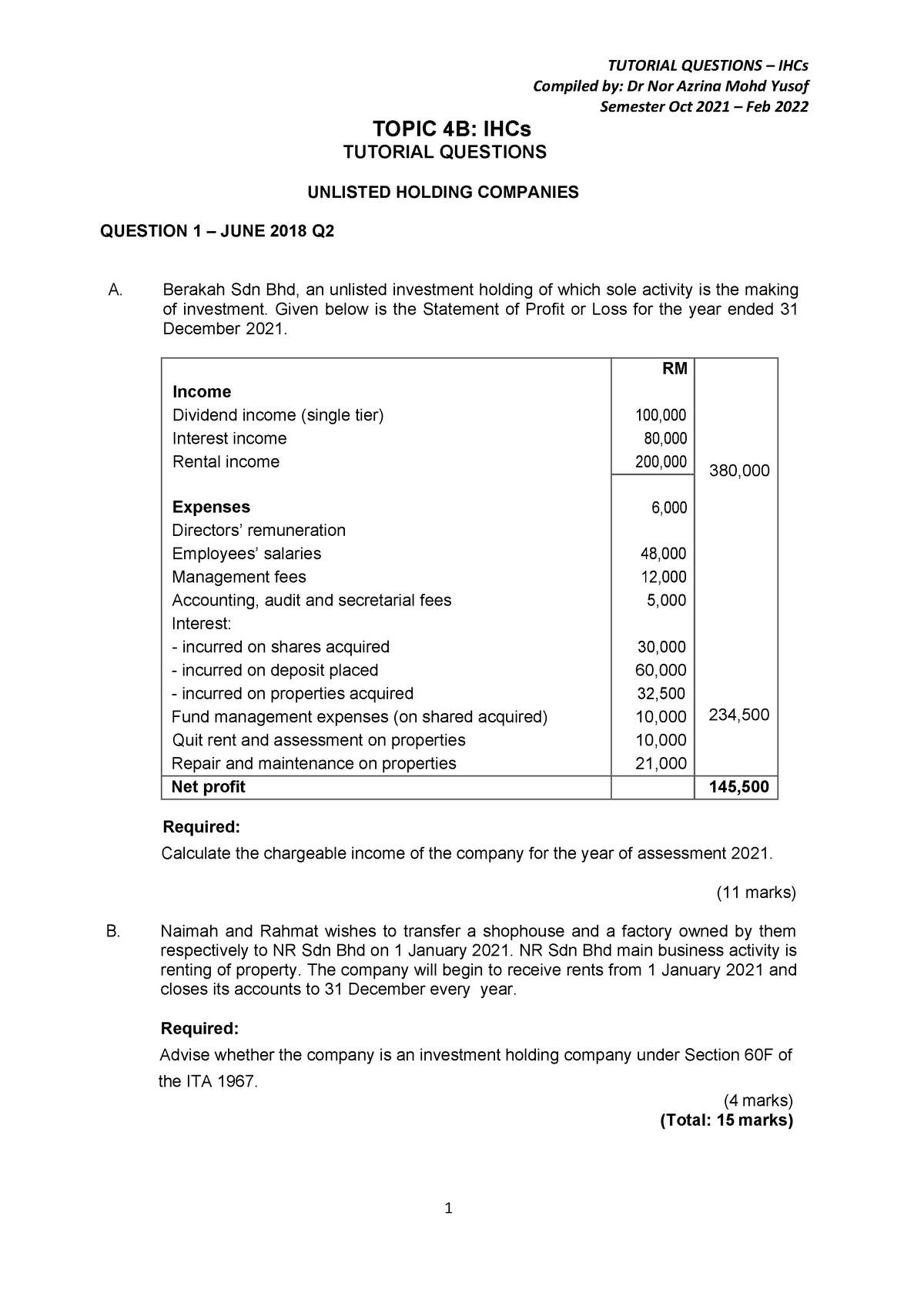

Tutorial Questions Ihc Tutorial Questions Ihcs Compiled By Dr Nor Azrina Mohd Yusof Semester Studocu

A Complete Guide To Quit Rent Parcel Rent And Assessment Rumah I

5 Vip Very Important Painful Property Taxes All Malaysians Should Know Propsocial

Useful Real Estate Investment Perspectives Free Malaysia Today Fmt

Old Tax New System With New Name The Star

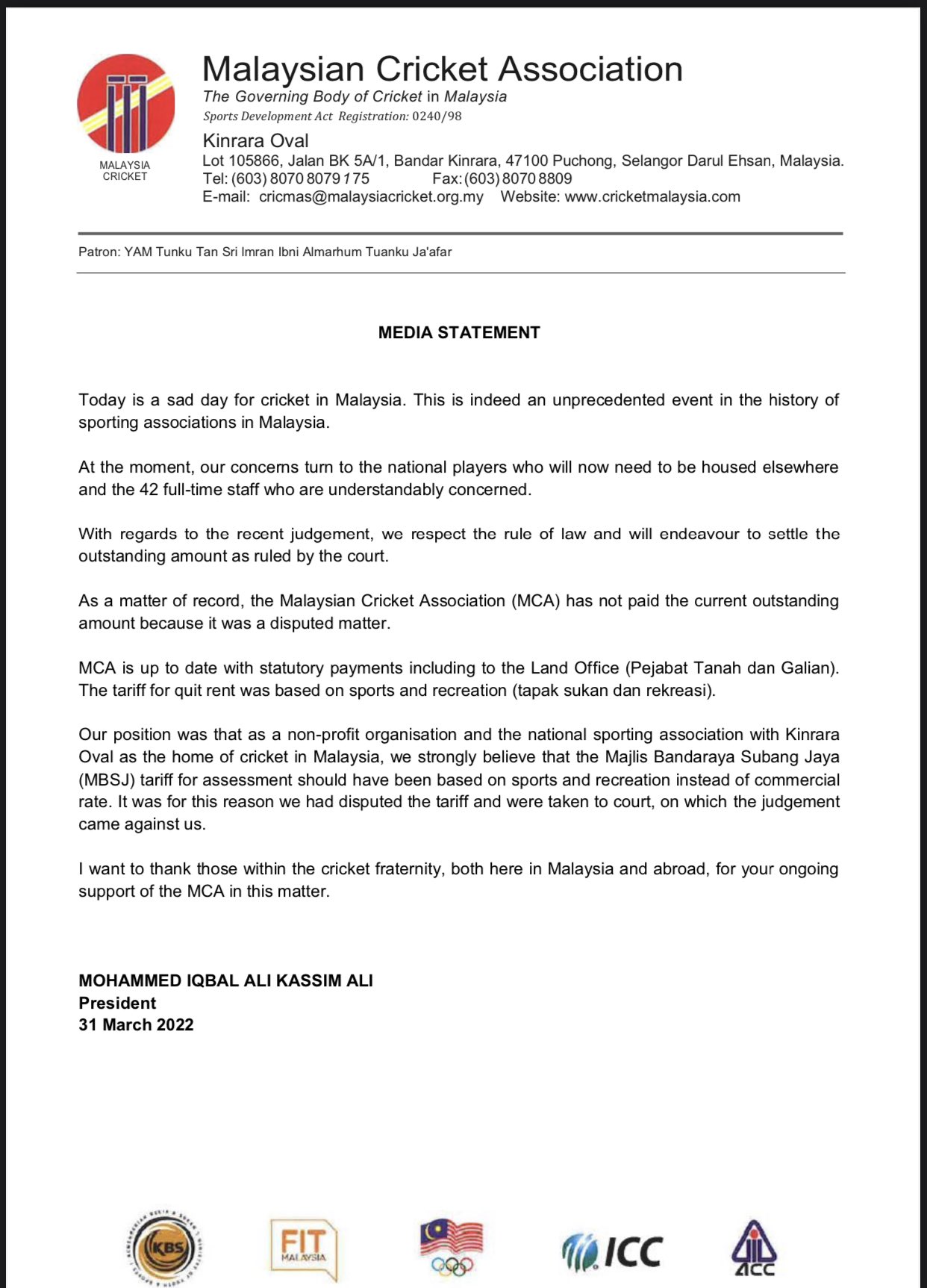

Malaysia Cricket On Twitter President S Statement Kinrara Oval Https T Co Vuadqxrw8r Twitter

Solved Investment Incentives Specialised Industries Course Hero

Quit Rent Cukai Tanah Rates In Each Malaysian State

What Is Assessment And Quit Rent

3 Types Of Homeownership Costs In Malaysia Quit Rent Parcel Rent And Assessment Rates

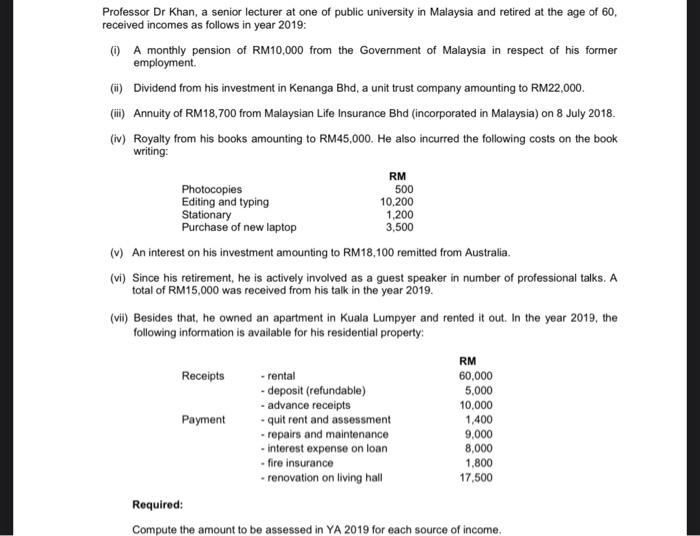

Solved Professor Dr Khan A Senior Lecturer At One Of Public Chegg Com

Cost Of Owning Property Must Know Before You Buy

3 Types Of Homeownership Costs In Malaysia Quit Rent Parcel Rent And Assessment Rates

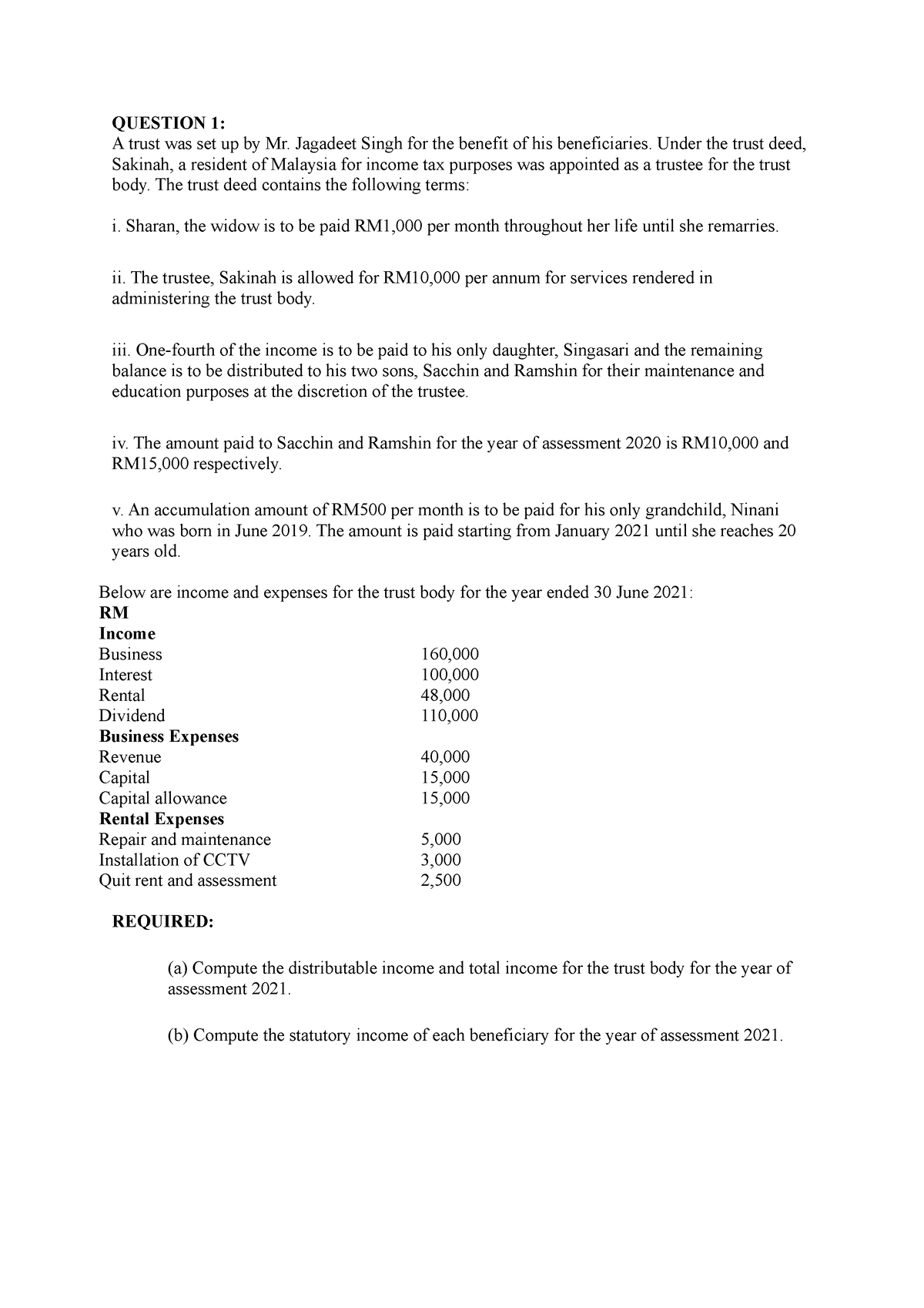

Tutorial Excercise Topic 8 Question 1 A Trust Was Set Up By Mr Jagadeet Singh For The Benefit Of Studocu

Quit Rent And Assessment Tax Case Study On Johore Bharu Malaysia B

Comments

Post a Comment