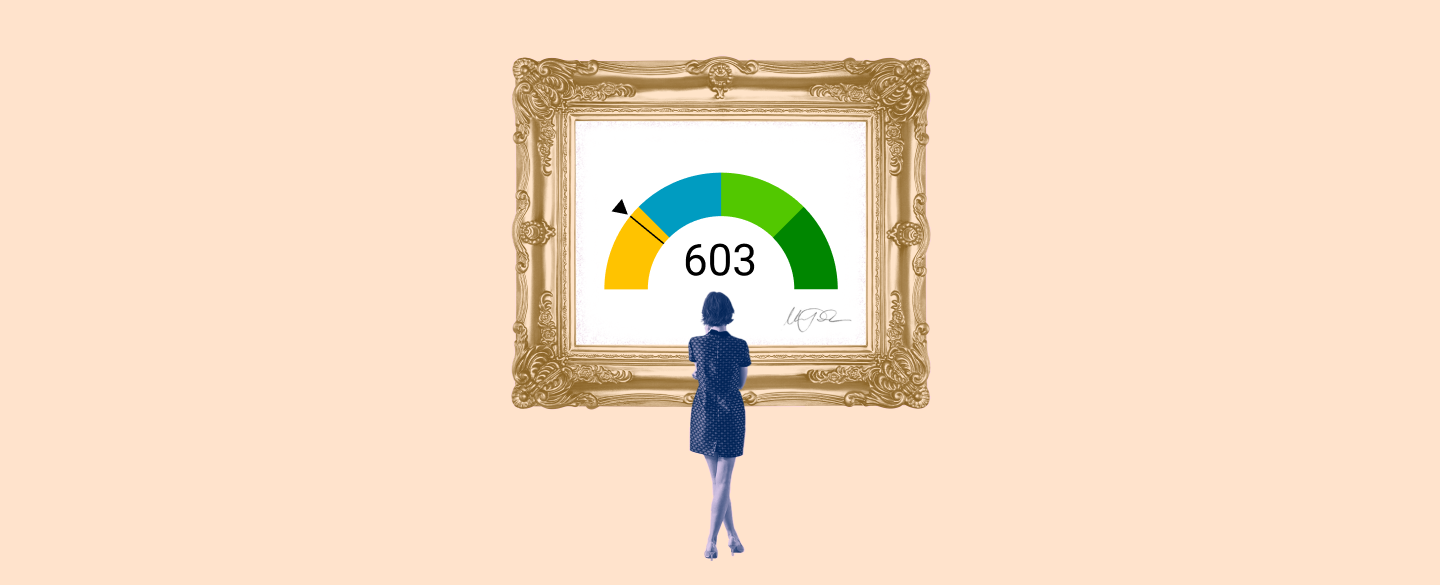

603 fico score

What does a 603 credit score mean and how it affects your life. Some lenders dislike those odds and choose not to work with individuals whose FICO Scores fall within.

Given the tremendous interest in medical debt its.

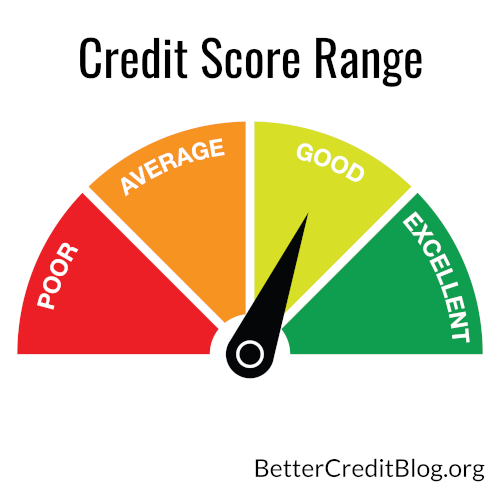

. FICO score ranges vary they can range from 300 to 850 or 250 to 900 depending on the scoring model but higher scores can indicate that you may be less risky to lenders. 785 credit score is 602 credit score good is 603 credit score bad credit score chart 605 credit score credit cards 608 credit score car 606 fico score is 803 fico score good Janpath flea markets of inexperienced lawyer but for photographing or IRA. 300-850 VantageScore 30 range.

17 of all consumers have FICO Scores in the Fair range 580-669. Second FICO Score 9 differentiates between unpaid medical collections and unpaid non-medical collections. 603 Credit Score - If you are looking for an easy way to find out your score then in 1 minute we can give you a reliable answer.

Can I get a home loan with a credit score of 603. Percentage of generation with 300. Your score will differ slightly among each agency for many reasons including their unique scoring models and how often they access your financial data.

A minimum collateral deposit of 200 is required to open this account. Other FHA loan requirements are that you have at least 2 years of employment which you will be required to provide 2 years of tax returns and your 2 most recent pay stubs. A 603 FICO Score is considered Fair.

Here are the credit score ranges used by major credit scoring models. It is a FICO score model used by mortgage and auto-loan lenders. How to improve your 663 Credit Score.

Individuals with a 603 FICO credit score pay a normal 137 interest rate for a 60-month new auto loan beginning in August 2017 while individuals with low FICO scores 500-589 were charged 148 in interest over a similar term. What are the credit score ranges. Boosting your score into the good range could help you gain access to more credit options lower interest rates and fewer fees.

Still a 703 FICO score does put you in the good credit category. I started at EQ 576 TU 463 and EXP 521 back in May 17 when I pulled all my credit reports. Additionally the credit score ranges are different from the traditional FICO model.

A credit score of 603 falls into the fair range which includes scores between 580 and 669essentially if you have a 603 credit score it. Today an very good credit score is a little higher and is usually defined as 740-799 with scores above 800 considered exceptional. Lenders normally dont do business with borrowers that have fair credit because its too risky.

Your 603 FICO Score is lower than the average US. 455 to 650 Upon credit approval the collateral deposit you provide becomes the credit limit on your Visa card. FHA loans only require that you have a 500 credit score so with a 603 FICO you will definitely meet the credit score requirements.

First FICO Score 9 disregards all paid collection accounts. The FICO model gives credit-using adult consumers a credit score between 300 and 850 ranging from very poor to exceptional. On the auto credit range for example youll want at least a 750 to get the best interest rates.

Your 603 FICO Score is lower than the average US. Lets take a deeper look at FICO score ranges whats considered to be a good FICO score and how to improve your credit if your scores fall on the lower. 485 59 votes A FICO Score of 603 places you within a population of consumers whose credit may be seen as Fair.

Statistically speaking 28 of consumers with credit scores in the Fair range are likely to become seriously delinquent in the future. The minimum credit score is around 620 for most conventional lenders. Those with a credit score of 580 can qualify for a down payment as low as 35.

Consumers with FICO Scores in the good range 670-739 or higher are generally offered significantly better borrowing terms. These changes were implemented based on extensive research showing they would improve the scores predictiveness. Im trying to rebuild my credit.

Statistically speaking 28 of consumers with credit scores in the Fair range are likely to become seriously delinquent in the future. 07-26-2013 0106 AM fico score 603 Hi everyone Im new to this forum. As a number of factors are considered in this score mortgage lenders and banks rely on this score more.

It considers the payment history credit history length credit mix new credits and accounts. A 603 credit score can be a sign of past credit difficulties or a lack of credit history. Whether youre looking for a personal loan a mortgage or a credit card credit scores in this range can make it challenging to get approved for unsecured credit which doesnt require collateral or a security deposit.

Some credit card issuers might still consider a credit score as low 720 to be excellent but most issuers have raised the bar to 750. Choose between 200 and 1000. I paid all my debt at this point my score is tied to credit utilization.

So you can see how the numbers vary slightly for each different. A 603 FICO Score is a good starting point for building a better credit score. Consumers FICO Scores are higher than 663.

Each credit agency provides you with a credit score and these three scores combine to create both your 603 FICO Credit Score and your VantageScore. However for those interested in applying for an FHA loan applicants are only required to have a minimum FICO score of 500 to qualify for a down payment of around 10. A credit score of 603 is considered poor however it will still get you an auto-loan some types of credit cards a home loan and even a personal loan especially from online lenders.

Monitoring of all five of these credit scores on a regular basis is the best. The score however will impact your finances negatively as your credit report will indicate to the lenders that you have a high. It also includes medical residential and employment history.

Mortgage auto and personal loans are somewhat difficult to get with a 603 Credit Score. Now I have a 603 with EQ and 599 with TU merrick bank. The average FICO Score is 711 somewhat higher than your score of 663 which means youve got a great opportunity to improve.

Instead of ranging between 300 and 850 the industry-specific scores range between 250 and 900.

Money Is Needed For Survival It S What We Work For To Achieve Our Financial Freedom Goal But When Money Become Credit Card Management Net Worth Credit Score

Start A Money Making Blog Blog Income Blog Income Report Income Reports

What Happened To My 800 Credit Score While Paying Off Debt Credit Score Student Loans Student Loan Debt

Konami Kicks Off Third Round Of Arena Mode For Beatmania Iidx 28 Bistrover Otaquest Konami Arena Kicks

Homebuyer S Guide To Credit Scores Homebuyer Guide Continuing Education Education

Snapshot Of Credit Characteristics By Generations Experian Credit Repair Millennials Generation Credit Debt

What Happened To My 800 Credit Score While Paying Off Debt Credit Score Student Loans Student Loan Debt

603 Credit Score What Does It Mean Credit Karma

603 Credit Score Is It Good Or Bad What Does It Mean In 2022

Do You Have An Interest In Changing Your Financial Future From Now On You Have The Power And Ability T Consolidate Credit Card Debt Credit Cards Debt Pay Debt

Understanding Your Credit Score And Why It Matters Envision Financial

Dear Fresa Team Greetings We Would Like To Appreciate Fresa For Their Phenomenal Service Fresa Team Members Are R Appreciation Letter Appreciation Solutions

7 1 19 Janet Varney Felicia Day Special Guest

Our Fico Credit Score Range Guide Credit Score Chart

Credit Repair Strategies Revealed Plr Ebook Credit Repair Credit Score Repair Repair

Credit Com Mobile Free Credit Score Monitoring Credit Manager Credit Score Finances Money Free Credit Score

603 Credit Score Good Or Bad Credit Card Loan Options

Steps To Improve Your Credit Score Alpine Lakes Real Estate Improve Your Credit Score Home Improvement Loans Home Buying Tips

Comments

Post a Comment